This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

ABCs of Corporate Climate Action: Why Shared Climate Language Matters More Than Ever

Posted on January 16, 2026 by Christina Carlton

#Business Case #Climate Change #Corporate CSR Reporting #Corporate Governance #ESG #ESG Issues #Risk Management #Sustainability Reporting #Uncategorized

By Christina Carlton, Sustainability & Climate Analyst, G&A Institute

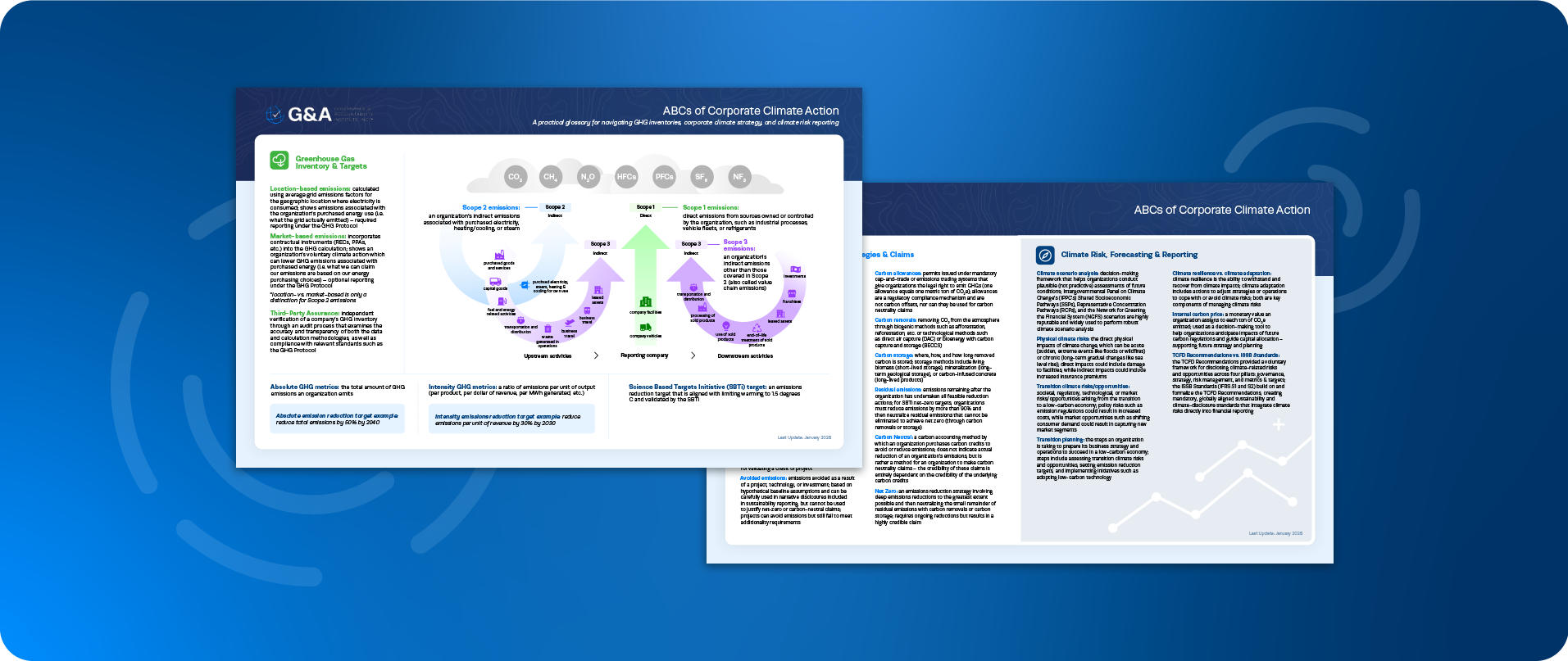

A new guide aims to help organizations align on the core concepts that underpin corporate climate action, accounting, and disclosure.

In 2026, climate terminology is a business-critical issue

Corporate climate expectations continue to rise, making clarity and consistency around climate terminology essential. Concepts such as science-based targets, net zero, and climate transition planning are no longer confined to sustainability teams, but are now essential knowledge for financial decision-making, legal risk, procurement strategy, and executive oversight. Yet many organizations still operate with a fragmented understanding of these foundational terms.

This lack of shared climate language can introduce real risk. Inconsistent methodologies for emissions accounting, misunderstandings about carbon credits and offsets, or imprecise use of climate claims like “carbon neutral” and “net zero” can undermine disclosure quality, which exposes companies to regulatory scrutiny and greenwashing concerns. As climate disclosure frameworks converge globally, particularly under the ISSB’s IFRS S1 and S2 Standards, companies are increasingly expected to demonstrate not just ambition, but technical rigor and internal consistency.

New glossary provides a practical reference for corporate climate teams

To support organizations navigating this complexity, G&A has released the ABCs of Corporate Climate Action. The quick reference guide provides clear, plain-language definitions of the core concepts underpinning corporate climate strategy, accounting, and disclosure. It covers greenhouse gas inventories and emissions targets, renewable energy and carbon market instruments, climate risk and scenario analysis, and the practical distinctions between technical concepts like avoided and residual emissions.

Each definition is grounded in widely recognized standards, including the GHG Protocol and the Science Based Targets initiative, helping companies anchor internal discussions in established best practice rather than informal or inconsistent interpretations.

Use common language to build alignment across internal teams

For corporate leaders, a shared understanding of climate terminology and concepts plays a critical role in strengthening governance and decision-making. As sustainability information becomes more integrated with financial reporting, organizations must ensure that climate-related assumptions, metrics, and claims are understood consistently across sustainability, finance, legal, procurement, and executive teams.

A common climate vocabulary supports more robust internal controls and greater confidence in external disclosures, particularly as stakeholders continue to demand transparency around both emissions reductions and climate-related risks.

Credible transition planning calls for a strong foundation

Ultimately, effective corporate climate action depends not only on setting targets or purchasing market instruments, but on building a strong foundation that supports credible transition planning. A shared climate language enables organizations to illustrate links between their emissions baselines, reduction levers, capital investment decisions, and interim milestones within a coherent transition pathway.

This foundational clarity supports effective transition planning, transparent climate disclosures, and long-term business resilience. The ABCs of Corporate Climate Action is your glossary for this journey; a concise reference to support the level of consistency expected in climate-related planning and reporting. Want to read the full paper? Download it here.

ABOUT CHRISTINA CARLTON

ABOUT CHRISTINA CARLTON

Sustainability Analyst, G&A Institute

Christina Carlton is a Senior Sustainability & Climate Analyst at Governance & Accountability Institute. She supports both sustainability and climate engagements, and her work bridges sustainability planning and reporting with targeted climate initiatives, helping companies enhance their ESG performance and integrate resilience into their overall sustainability frameworks.